How to use payments for the next step of growth

When looking for the next step in scaling your software company, it is natural to think of additional business models or new product offerings as the go-to solution. Historically, successful software companies like Amazon, Microsoft or Shopify always started to broaden their initial offering to new categories or connected services to ensure their edge against competition.

Think for example of how Amazon started with offering fulfillment and payment services for their merchants as the next logical step after conquering the e-commerce market (and obviously AWS). Of how Microsoft added games, hardware and now AI to their business model. Or of how car makers started to hand out financing offers to their customers at the dealership. There are countless examples.

In today’s turbulent environment, creating multiple and diversified revenue streams from different offerings seems more important than ever. Especially for players, who already established a strong market position or have at least proven their product-market fit.

In this article we are going to elaborate on the topic of why owning payments can be the next logical step in your growth phase and give concrete examples of how to implement payment product strategies which can supercharge revenue growth.

Owning payments is practically riskless

Adding new products or services to the existing offering comes almost always with substantial risks:

What if the new product/service isn’t successful?

How many resources/ how much investments do I need?

Do I threaten any main operations with distractions?

These questions are crucial in elevating the potential of new offerings.

So far a proven strategy to reduce market and product risk was to go along the vertical chain of the “main” product. Amazon started to offer fulfillment and payments, because these services are tightly connected to their e-commerce business and act as a logical extension of their offerings. Amazon soon realized that they missed out on a lot of growth potential by having customers they already acquired, complete processes on entirely different platforms without having any influence on the experience and being part of the value chain.

But by integrating fulfillment and payments they not only gained substantial process control but also created an unmatched service offering due to product bundling. Suddenly, Amazon was able to combine fulfillment, selling and payments into one offering and price it aggressively without sacrificing revenue. On the contrary, by owning and treating the different parts as one, they made substantially more money compared to using third party providers. And since both fulfillment and payments are so closely related to the initial offering of selling goods, they created little to no risk for the company in terms of adoption.

In the next chapter, we are going to focus particularly on payments and see how embedding payments can act as a similar logical business extension for platforms and marketplaces.

Possible Payment Strategies for Software Companies

When looking at adding payments as a business model, software companies need to consider a few steps before implementing it as a product item.

Step 1: Identify payment channels related to business

Usually payment streams of software companies can be classified into three categories:

1. Subscription Billing: Charging merchants a recurring fee for using your software

2. Value adding products / services: Usually one-off transactions for additional services for merchants

3. Platform Transactions: End-customer transactions made via your software / platform, usually for selling goods / services of your merchants

With all identified payment streams we can quickly see that usually all of these streams operate independently in silos. Single transactions are executed without any interconnected strategy and in some cases even with different third-party providers.

Step 2: Combine payment channels under one pricing strategy

Now let’s see what happens when we combine all payment streams under one umbrella. By having control over payments capabilities, software companies have tools to bundle offerings in different ways in order to find sweet spots for incentivization and the optimal combinations.

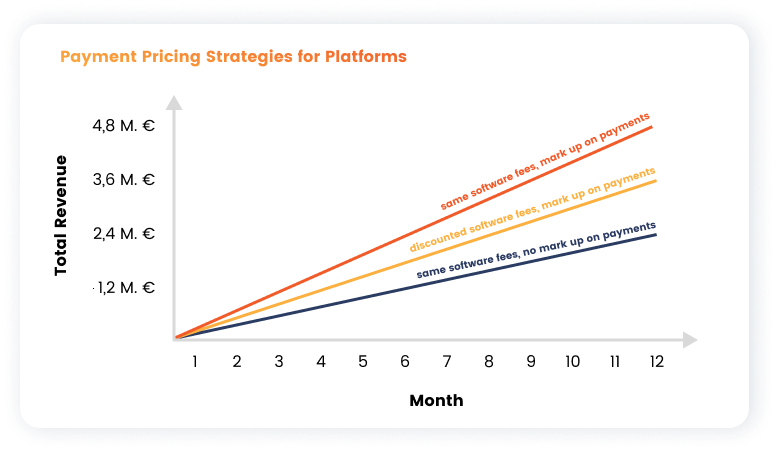

In this context you can work with many bundling strategies - depending on the needs and growth phase of your software company. For the sake of simplicity, we focus our attention on two strategies:

Keep SaaS-fees constant, mark up transactions on platform:

By embedding payments rails you transition from a third-party dependence to first party offering. This also means, that you have full control over pricing rather than paying what an incumbent payment provider is dictating. With that in mind, you have the opportunity to offer payments to your customers at the price you and your merchants feel comfortable while earning a margin for each transaction.

Lower SaaS-fees, mark up transactions on platform:

This may sound counterintuitive at first glance, but has many advantages over the first strategy when it comes to market penetration and outgrowing tight competition. By leveraging the payments revenue stream you are able to reduce prices on the main product and thus incentivise more merchants to try out your product. In some cases you can even scrap SaaS fees completely or for a specific time period without experiencing a revenue drop.

Assumptions: Number of monthly transactions: 500.000 , Average transactions size: 80€, Number of merchants: 2.000, SaaS fee for merchants: 100€ / month, Payment margin: 0,5%

Unifying Payments

We have seen that creating a unified payments strategy can fuel growth for platforms and marketplaces. By controlling payments streams, companies can take advantage of new pricing capabilities and thus gain an edge against competitors. Embedding payments is just one piece of the puzzle, but it can represent a quick win for boosting revenue without adding substantial risks. And the best part, with today’s technology, you won’t need huge investments like Amazon, Microsoft or Shopify did.