The vital role of extensive data and analytics in payments

In the digital age, businesses have access to an abundance of data that can be harnessed to propel company growth and drive strategic decision-making. Nowadays it seems like there is not a single important decision made without the consultation of data or some business intelligence function.

Among the diverse range of available data, payment analytics emerged as a potent resource for unlocking new revenue and growth potentials.

Historically payment analytics has focused a lot on understanding which payment options clients prefer and how to optimize checkout for conversion in order to boost product and service sales.

Think of adding important payment methods (eg. PayPal) or reducing the amount of process steps as a way of using analytics in order to gain valuable conversion insights. Focusing on particular optimization methods can for example bump up conversion rates by 2 percentage points which later down the line creates more revenue.

In this blog post, we will explore the immense potential of payments analytics and try to go beyond the usual tactics. We will learn how much more data we can get from a financial transaction and how to use it to propel your company to the next level of growth.

Understanding the worth of payments data

Payment transactions generate a wealth of information that extends beyond mere financial records between two parties represented by a sum or/and a date. Each transaction provides valuable insights which we have divided into the following type of categories:

Purchase Details: Payment transactions provide information about the products or services being purchased. This includes details such as the specific items, quantities, prices, and any applicable discounts or promotions. Understanding these purchase details helps businesses identify popular products, optimize inventory management, and make data-driven decisions regarding pricing and promotions.

Customer Information: Payment transactions often include customer details such as names, email addresses, shipping addresses, and billing information. This information can be used to create customer profiles, segment customers based on demographics, and personalize marketing efforts to enhance customer engagement and loyalty.

Payment Method: Each transaction reveals the specific payment method used by the customer, whether it's credit cards, debit cards, digital wallets, or alternative payment methods. Analyzing payment method preferences can help businesses optimize their payment infrastructure, identify trends in preferred payment methods among different customer segments, and enhance the checkout experience.

Transaction Timing: Payment transactions provide timestamps that indicate the date and time of the purchase. Analyzing transaction timing can reveal patterns such as peak sales periods, seasonal variations, and the impact of marketing campaigns or external events on customer behavior. This information enables businesses to optimize inventory levels, plan marketing initiatives, and allocate resources effectively.

Geographical Information: Payment transactions can provide insights into the geographic locations where purchases are made. This information helps companies identify regional preferences, target specific markets, and tailor marketing strategies to different locations.

Fraud Indicators: Payment transactions can also deliver indicators of potential fraud or suspicious activities. Unusual patterns, such as multiple transactions from different locations or high-value purchases deviating from typical customer behavior, can be flagged for further investigation. This information aids in fraud detection and prevention, protecting both the business and customers.

Adding significant transparency

The categories above show us that in order to maximize and increase payments revenue, complete transparency into how payment transactions are split down is essential. Platforms who understand the entire transaction lifecycle are better able to reap the benefits of their database.

But there is a catch.

Most payment providers don’t disclose a detailed dataset of their payments data. Instead, they provide you with scant details like settlement sum and transaction date. Most of the time, all the valuable insights are under closed doors or provided at a hefty surcharge.

Plus, there is a limitation to raw data. Without added context, it's hard to derive meaningful insights. Analytics works best, if data is not only available but also prepared and structured.

Data at getpaid

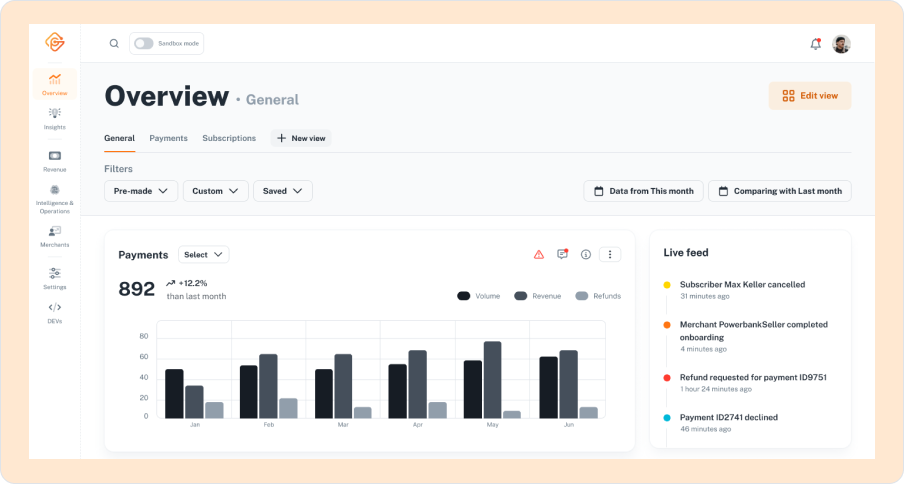

Let's look at the amount of detail we offer at getpaid to properly understand the impact that extensive data visibility has. We took the above mentioned categories and re-structured them to a more function driven interpretation allowing for optimal support when analyzing different contexts.

The following is an excerpt of data points we provide, each category representing subcategories with multiple data points:

Volume and Revenue

Total Payment Volume: How much payment volume you are processing filtered according to various timeframes and sub-categories like merchants, geography, product-categories, payment method, …

Total Net Income: Revenue generated from total payment volume filtered according to various timeframes and sub-categories like merchants, geography, product-categories, payment method, …

Costs

Total fees: Total amount of fees linked to total payments volume filtered according to various timeframes and sub-categories like merchants, geography, product-categories, payment method, …

Single transaction fees: Fees per transaction broken down into sub-categories like interchange (if applicable), card network fees (if applicable), third-party fees (if applicable), (revenue shares (if applicable), …

Operations

Transactions: Detailed information on transactions, including amount, method, current status, level 2 / 3 data, complete trackable lifecycle as well as fees and cost data

Payouts: Scheduled payouts including transactions reference, destinations and method (if applicable)

Onboarding: Active and onboarded merchants as well as pipeline of newly acquired merchants in the process with associated status, lacking documents and required next steps

Risk

Chargeback Rates: Detailed information on chargebacks filtered and associated to categories like payment method, country, merchant, …

Disputes: Overview of current status, required next steps, communication history, wins / losses quote filtered and associated to categories like dates, merchants, countries, …

Outstanding Refunds: Amount and volume of outstanding, pending refunds filtered and associated to categories like dates, merchants, countries, …

Facilitating strategic decisions

Now let's take a look at the kind of strategic decisions we can make from an extensive payments data set:

Vary fees for merchants: Use geographical, risk or product data to vary fees for merchants operating in certain settings. I.e. raise fees for merchants with high chargebacks, lower fees for merchants with risk-less products.

Run different revenue strategies: Test different types of pricing strategies (e.g. geography, type of products, new merchants vs. established merchants, payment methods, …) to maximize revenue potential.

Optimize disputes for customer experience: Use extensive dispute status data in order to analyze what factors contributed to successful settlements

There are countless other ways to use data for improving operational efficiency. That's why we at getpaid decided to provide the whole picture. Making information as accessible as possible is our aim. This means also providing tools for cutting and analyzing data to specific needs and roles so the most crucial financial information will be displayed as soon as you login into your dashboard.

In the era of data-driven decision-making, payment analytics is an essential and powerful tool for unlocking revenue growth and driving company success. Embracing this trend is more important than ever since AI is already waiting in the starting blocks to conquer the world. In the next blog post we will therefore learn, how we combine extensive datasets with the power of artificial intelligence to bring payments insights to the next level.